Friday, June 17, 2005

Quest for Genomic Testing

"If the industry agrees on anything, it is the opportunity presented by diagnostic tests being developed to assess illness, or even the risk of future illness, by analyzing a patient's DNA and RNA, the storehouses of genetic information. New and nonroutine tests are the only part of the business consistently growing at double-digit rates," writes Times reporter Barnaby J. Feder.

Medical testing is a $41 billion market with single-digit growth. But genomic testing, while an emerging sector, is producing double-digit growth, and Quest is moving to improve its share, according to The Motley Fool. In an article published this week, the online investing publication, said genomic testing is currently required in 7 percent of all tests. Hospitals today conduct 60 percent of all testing, but may not be able to translate that dominance into the genomic testing market because of the hurdles required to install new equipment, administer the new tests and the fees and royalties required. The Fool said that last year, Quest generated $600 million, or some 12 percent of its revenues, from these types of tests. The article said that Quest, and LabCorp, with their wide coverage of the marketplace, are positioned well to take advantage of this opportunity.

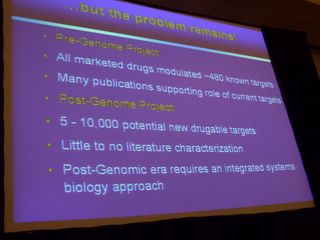

New Biology Economy take – These two articles illustrate well the changes that genomic testing may bring to the healthcare marketplace. However, it is very early. There are very few scientifically proven and FDA-approved biomarkers, which must be the basis for these tests. That is where biomedicine is concentrating these days, understanding what it doesn't know, and organizing under the banner of systems biology or integrated biology, to create knowledge, and the technology to enable innovation to move from academia to the Quests and LabCorps, as well as the hospitals, to the benefit of patients. It's a tangled thicket of patents and royalties as well as being technically challenging, and one where there isn't a labor force skilled enough to handle today's volume, much less tomorrow's.